Australia, we have a debt problem. Are YOU prepared?

Promoted by Confidence Finance.

Housing markets are in decline, interest rates are increasing, interest only periods are expiry, household debt is at record highs, new housing supply is at record highs & obtaining finance has become increasingly difficult.

This is a dangerous combination for Australia.

It means that many households across Australia are at more risk today than ever before.

In uncertain times, it is crucial you are prepared for changes in economic and financial conditions. It is what you don’t know that can hurt you’re the most.

That is why we have developed MoneyBRAINS- a FREE new finance tool that helps you better understand your finances.It works by asking you 20 simple questions about your finances. Once answered, the technology will automatically work out:

- Can you refinance your existing loans and save thousands of dollars?

- How much can you borrow for investment properties?

- What happens when your interest only period expires?

- What happens to your finances if interest rates rise 1 or 2%?

- Are you under mortgage stress?

- Where you can save money?

- How much 'buffers' should you hold specific to your situation?

- What should your investment strategy be – consolidate or grow?

- How much risk are you really in?

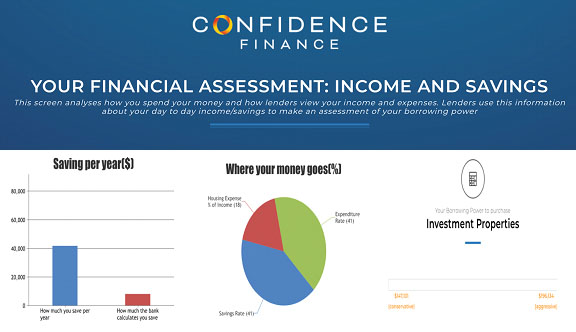

That is, MoneyBRAINS allows investors to get a summary of their current financial & risk position. Investors can unpack their household finances in a concise, accurate and detailed way. This will help ensure that investors are not blindsided by risks you didn’t know about. Below is an example household assessment.

Figure 1: MoneyBRAINS analyses your financial position and provides users simple & accurate information about their financial position. Best of all, MoneyBRAINS provides users this information for FREE & INSTANTLY.

Confidence Finance mission is to help educate Australian’s about their finances. We have developed MoneyBRAINS to help educate investors by providing a holistic reflection of their financial position.