What is Division 40?

There are two categories when it comes to tax depreciation, and every component of your investment property will fall into one or the other.

- Division 40 - Assets / Plant and Equipment

- Division 43 - Building/ Construction/ Capital Works

Put simply, Division 40 – Assets/Plant and Equipment are (individual or grouped) assets within your investment property that are easily removable, electronic in nature or soft furnishings. Some examples of Division 40 assets include: dishwashers, stoves, blinds, carpets, fans, air conditioners, hot water systems and smoke alarms.

Division 43 – Building /Construction/Capital Works is the remaining structural component of your investment property. Some examples of Division 43 components include: roof tiles/colorbond fence, bricks, framing, weatherboards and hard landscaping.

Deductions for the wear and tear of your investment property may be available for both brand-new and existing properties under both categories. Total tax deprecation for most investors are in the thousands and it can reduce your tax payable, so it is always worth looking into.

I was told that I can’t claim Division 40 on my secondhand property?

This is something we find a lot when talking to investors as Division 40 claims were affected by legislation changes way back in May 2017. They are still being misunderstood among property investors and professionals, with some believing that the changes meaning it is not worth organising a capital claims tax depreciation schedule at all.

Although the changes to the legislation were significant, the key change was the timing and the way in which potential Division 40 claims were made. The change means that you can no longer claim secondhand assets as part of your annual capital allowance and tax depreciation deductions.

However, there is still opportunity to claim against these values at the end of your investment property journey rather than the start. This is called a “Deferred or Future Division 40 - Capital Gains Tax Offset”.

These values can total thousands and accumulates each financial year going forward. If you were to sell your property in five years or 10 years or 40 years’ time, the accumulated value can be deducted from any capital gains tax liability that you owe.

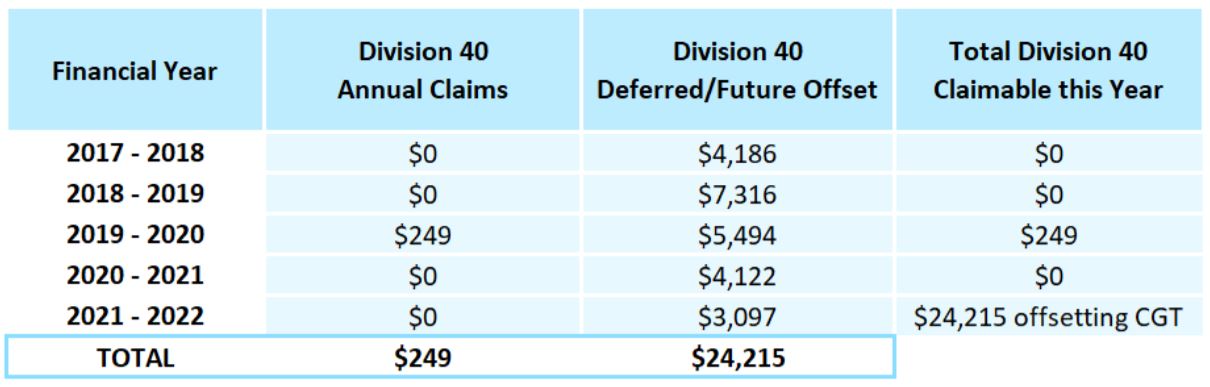

For a simplified example, a client Huan purchased a secondhand unit in a large complex in December 2017. The unit was built in 2015, it has two bedrooms and two bathrooms. The only addition Huan made to the property over her ownership was a ceiling fan installed in the main bedroom for the cost of $249 in 2020.

Below is what Huan is entitled to claim in Division 40 as well as what she can use to offset her capital gains liability.

Excluding all other factors, if Huan sells her property in June 2022, she will have the ability to reduce her capital gains tax liability by $24,215.

Is Division 40 treated differently for my residential property to my commercial property?

Yes. There are a number of differences between the Division 40 assets for residential and commercial properties. Commercial properties can claim for second-hand assets. Also, the individual assets within the commercial property that are claimable, will differ between industries as well as the effective life attributed to each of those assets.

For example, light shades installed at your residential investment property are given the effective life of five years, whereas lighting plant in a commercial setting could have an effective life of anywhere from three to 20 years depending on the industry.

I purchased a dishwasher for my investment property. Can I claim the tax depreciation deduction?

If you purchased a brand-new dishwasher, you are entitled to claim the tax depreciation deduction from the date you installed the dishwasher at your investment property. This rule applies for qualifying and all brand-new assets you install.

If you purchased a secondhand dishwasher and installed after May 2017, a value is still calculated and attributed to your dishwasher, and this value may be used to reduce any capital gains tax liability if and when you sell your property. This rule applies for all secondhand assets you install after May 2017.

What is immediate write-off and low-value pooling mean?

Whilst a property’s structural component depreciates steadily over 40 years, the diminishing value method of depreciation allows for qualifying Division 40 Assets to be grouped and pooled or even immediately written off in some cases.

Assets that are valued less that $1,000 can be pooled together with other “low-cost or low-value” assets, and they are depreciated at an accelerated rate of 37.5 per cent.

Likewise, assets that cost less than $300 can be written off at 100 per cent allowing for an immediate write off.

Mark Wilkins is the managing director, quantity surveyor, tax depreciation expert at Capital Claims Tax Depreciation.