Rent increases stall despite vacancy rates at record lows

CoreLogic’s Quarterly Rental Review for Q3 2022 indicates that vacancy rates continue to plummet, this time reaching record lows.

The research firm’s data illuminated the fact that the national rental index was subject to its smallest monthly increase this year, rising 0.6 per cent in the month to September and 2.3 per cent over the quarter, a decrease from the 2.9 per cent recorded in the three months to June.

You’re out of free articles for this month

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

According to CoreLogic research analyst Kaytlin Ezzy, supply maintains its position as a primary driver behind tightening conditions, given that the total supply of advertised rental is down 35.4 per cent on the previous five-year average.

Vacancy rates contracted from 1.3 per cent to 1.1 per cent during the quarter, with Ms Ezzy describing that “one factor [that] has likely negatively impacted rental supply is the decline in investor purchasing activity between early 2017 and early 2020”.

Ms Ezzy detailed how “through this period, a mix of temporary changes to mortgage lending conditions, and the uncertainty surrounding the onset of COVID-19 limited residential property purchases”.

“Additionally, CoreLogic recorded an increase in investor-owned housing stock being listed for sale through 2021 and into 2022, with many investors possibly looking to maximise capital gains through the upswing,” she said.

Despite rental growth slowing in the September quarter, annual rental growth has held steady at a record high of 10 per cent through August and September, led by 13.5 per cent growth in Brisbane over the past 12 months, the largest of any capital city.

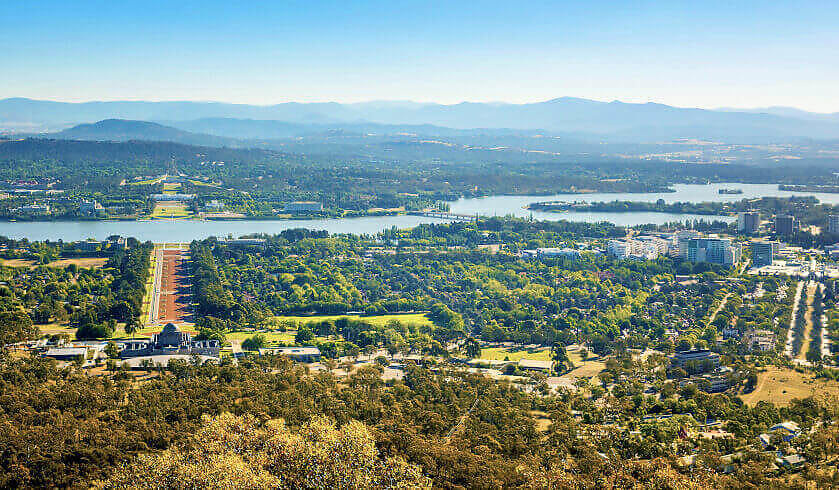

The Queensland capital led the charge for growth in the three months to September, jumping 3.8 per cent, closely followed by Adelaide and Darwin’s 3.6 per cent. Conversely, dwelling rents in Canberra fell 0.4 per cent through the September quarter, bucking the national trend as a result of a 0.9 per cent fall in house rents.

Combined capital rents grew over twice as much as those in the combined regions throughout the quarter due to the large influx of overseas migrants that commonly opt to reside in high-density markets within Sydney and Melbourne.

“While both markets saw the pace of quarterly growth ease compared to the June quarter, the decline in the rate of growth seen across the combined regional markets was significantly stronger,” Ms Ezzy explained.

“However, despite the easing growth trend, rental availability in both markets remains extremely tight, with the capitals recording a monthly vacancy rate of 1.1 per cent while just 1.0 per cent of regional rental properties were observed as vacant in September.”

Ms Ezzy elaborated that conditions driving rent increases have transformed over the last two years from “a reduction in the average household size” that characterised the rental increases experienced during the early months of the pandemic through to the “strong return of overseas migration, coupled with extremely tight rental supply” that are at hand presently.

At the conclusion of the September quarter, Canberra maintained its position as the country’s most expensive city, with a median weekly rent of $682, followed by Sydney at $665. Darwin rounds out the podium positions at $590 per week.

Melbourne maintained its status as Australia’s most affordable rental market, with landlords charging, on average, $495 per week, followed by Adelaide at $508 and Perth’s $580 weekly rent.

“With Sydney recording strong rental growth at a time when rents are declining across Canberra, the gap between Australia’s two most expensive rental markets has narrowed to just $17 per week,” Ms Ezzy said.

She concluded that the continued increase of international migration as well as affordability hindering the national capital, “it’s likely we’ll see Sydney overtake Canberra as Australia’s most expensive capital city rental market in the coming months”.