Sponsored by:

As a property gets older and the building and the items within it wear out, property owners of income-producing properties can claim a tax deduction relating to wear and tear.

To claim these deductions, investors need a one-time tax depreciation schedule cataloguing the wear and tear expected on a specific property - and there’s no better time to get this in order than at EOFY.

Bradley Beer, the chief executive officer of tax depreciation quantity surveyors BMT, explains that a thorough tax depreciation schedule will include a number of important elements.

These elements include:

Bradley Beer - CEO BMT Tax Depreciation

“Investors who use depreciation schedules will experience different cash flow outcomes in their property portfolios compared to those who do not,” Beer explains.

Depreciation schedules allow investors to claim tax deductions on the depreciation of their property’s building structure and assets. This can significantly reduce their liability, leading to higher after-tax cash flow.

The CEO says “investors with higher cash flow have more funds available for reinvestment, to pay down debt or for covering property-related expenses, potentially improving the performance of their portfolios.”

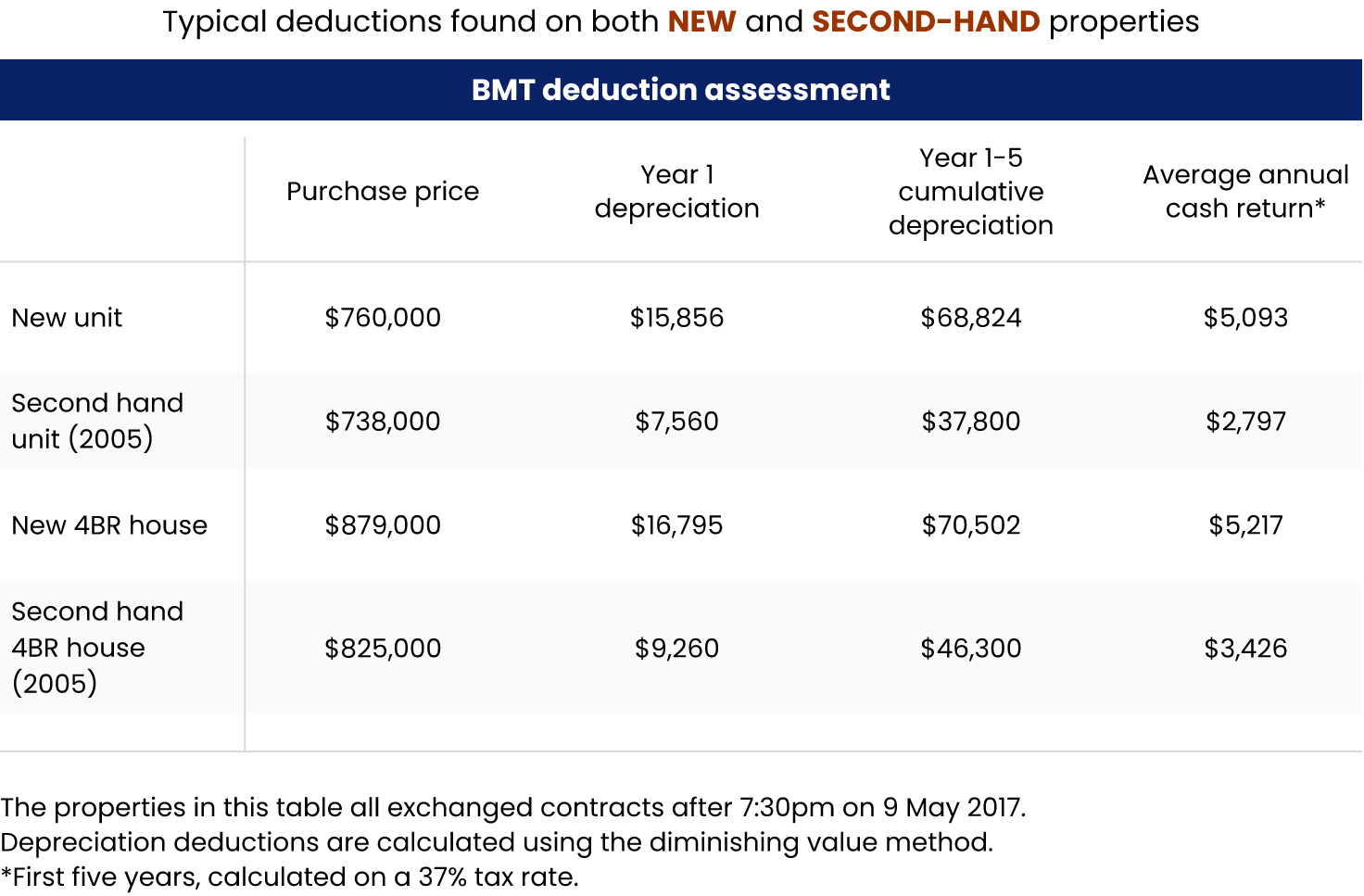

BMT finds owners of new residential investment properties an average first full financial year deduction of $15,234, and owners of second-hand properties an average of $8,925.

“The additional cash flow and tax savings can be used for property improvements and maintenance, which can increase the property’s value. Well-maintained properties are more likely to appreciate and attract higher rental income,”

Bradley Beer - CEO BMT Tax Depreciation

Beer notes, re-iterating how a depreciation schedule pays dividends beyond the immediate tax deductions.

“The additional financial benefits gained from depreciation can also help mitigate risks associated with property investment, such as vacancy periods, unexpected repairs, or market fluctuations,” he notes.

In Beer’s view, it’s never too early to consult with a depreciation specialist, with many new investors reaching out before they’ve purchased a property.

Once an investment has been acquired, Beer suggests owners should take advantage of depreciation deductions from the outset, pointing out that “depreciation can be claimed as soon as the property is genuinely available for rent”.

Beer says that depending on whether the building was new at the time of purchase determines when depreciation comes into effect.

“In the case of a newly built property, the investor can maximise the depreciation deductions available over the full 40-year life time of the property”.

“If the investor has bought a second-hand property there are two potential scenarios. In the first case the investor will be happy with the current state of the property and it will simply be put up for rent. It is a common myth that older properties will attract no depreciation claim. However, both new and old properties will hold some depreciation benefits. In this case the depreciation specialist will compile a depreciation schedule after assessing all the depreciable assets during a site inspection.

He warns: “Investors considering completing any work to their property should contact a specialist quantity surveyor before they start work. This is important during the removal or demolition of any existing structure or fixture onsite that would have been eligible to claim deductions for depreciation (Division 40) or capital works deduction (Division 43).”

Scrapping assets can entitle the owner to additional claims, and any remaining un-deducted depreciable value could be claimed as a 100 per cent deduction in the same financial year as the item’s disposal.

Property depreciation is beneficial for both residential investment and commercial properties, including childcare centres, hospitals, restaurants, industrial properties, shopping centres, fitness centres and beauty salons to name a few, according to Beer.

He notes that property depreciation deductions are split into two categories, which apply across property types:

Division 43 Capital works deductions refer to the building structure including walls and roofs, as well as the assets permanently fixed to the building including windows, doors and flooring.

Division 40 Plant and Equipment refers to assets that are mechanical in nature or are easily removable including air conditioning units, carpets, furniture, appliances, and other fittings.

According to Beer, the expert preparing your tax depreciation schedule will come with a specialist blend of property industry experience, including “a combination of construction cost expertise and knowledge of taxation legislation to concentrate on property depreciation”.

“Quantity surveyors are one of a few professionals recognised by legislation (Tax Ruling 97/25) to have the appropriate construction costing skills to calculate building costs for capital allowance claims. The ruling also states that accountants, solicitors, real estate agents and valuers are not recognised to estimate construction costs for claiming capital allowances,” Beer illuminates.

Membership with bodies such as the Australian Institute of Quantity Surveyors (AIQS) or the Royal Institution of Chartered Surveyors (RICS) is also important - with these memberships requiring ongoing professional development and adherence to industry standards.

BMT Tax Depreciation recently consulted on the AIQS’ introduction of a standard for ethical conduct and collaboration within the industry, The Quantity Surveyor’s Guide to Residential Tax Depreciation.

Promoting industry-wide consistency, preventing unethical practices, and ensuring the protection of clients, accountants, and quantity surveyors, it lays out a comprehensive framework for depreciation specialists to minimise risks.

To find out more about the industry leading work being done by BMT and how they can help you kick your EOFY goals, click here.

Bradley Beer - CEO BMT Tax Depreciation