The numbers are everything when developing

Regardless of your situation the most important factor when considering whether to develop your property is the numbers. If the numbers don’t show that the project results in a positive outcome for you then there isn’t a lot a point in pursuing the development further.

Regardless of your situation the most important factor when considering whether to develop your property is the numbers. If the numbers don’t show that the project results in a positive outcome for you then there isn’t a lot a point in pursuing the development further.

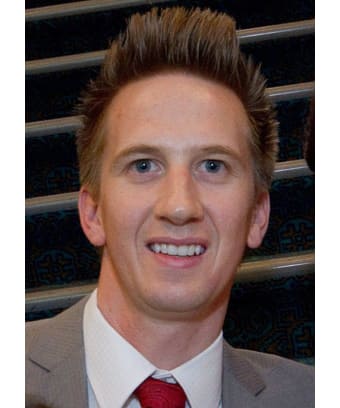

Blogger: Darren Standish, Property Prosperity

There are many items to consider when calculating the financial costs and benefits of the project however it is useful to analyse your project it 2 ways

1. Cashflow (Money in & Money out)

2. Equity (The value of the project)

Cashflow considers the actual money going into and out of your pocket associated with the project. Where you already own the property there will not be any cost associated with purchasing the property, however if you are yet to purchase the property then this amount and any associated purchase costs must also be included.

If we assume you already own the property and wish to demolish the existing house, subdivide one into two, sell one block and build on the remaining then the following items will result in Money out

• Subdivision Costs

• Demolition Costs

• Building Designs

• Consulting Fees

• Holding Costs

• Construction Costs

• Marketing Costs

The main source of Money in obviously comes from the sale of the vacant block.

If we compare the Money in & Money out overtime this will also highlight where shortfalls of cash may require some additional funding to ensure that the project doesn’t run out of money before completion.

The financial outcomes resulting from the development may be viewed differently if we consider the effect the project will have on the value of the property.

Using the same example as above to determine the increase in value as a result of the development we must first consider the current market value of the property and then add this to the costs associated with the development. We then compare this to the future market value of the vacant block for sale and the newly constructed home to determine whether there has been an increase in value as a result of the development.

It is common for there to be only a marginal difference between Money in and Money out of the project however there may be a considerable increase in the value of the property after it has been developed. This may be because the newly constructed home may be worth considerably more than the costs associated with building it.

About Darren Standish

Darren Standish established Property Prosperity in 2004 initially as a property development company, however after repeated requests for assistance the business evolved into a development consulting business.

Property Prosperity was initially focused on assisting clients with subdivisions and negotiating with councils to ensure that clients maximized their return on investment. Over the years additional services were gradually added to ensure the development process was as seamless as possible for its clients. We expanded into offering individually tailored finance solutions and then added Property Development Analysis, Property Sales and a Builder Broker Services.

Darren is the overachiever of the team and has more qualifications than your average university graduate. As well as completing a Bachelor in Economics, Bachelor in Commerce and post graduate in Accounting he subsequently went on to complete a Diploma in Financial Service, Diploma in Real Estate and Certificate IV in Building. He is a qualified Certified Practicing Accountant (CPA), a licensed Real Estate Agent, licensed Mortgage Broker and holds a Builders License.