Here’s Why The Next 3 Years Will Be BETTER Than The Last 3 Years

Promoted by Propertyology

Contrary to recent media headlines which suggest that property markets are cooling, Propertyology predicts that the next three years will prove to be better than the last three. Yes, better!

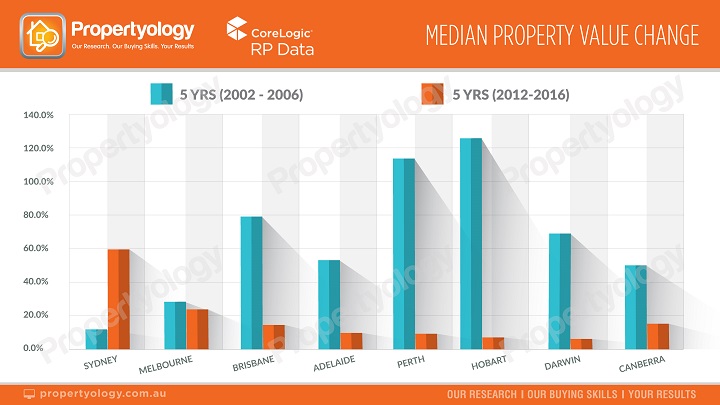

The fundamentals of property markets for 5 out of 8 capital cities and most of regional Australia look decidedly better for the next few years than they were for the last few years.

Affordability, improving economic conditions, and out-of-town investors (interstate and international) will drive an increase in property buyer activity in Adelaide, Brisbane, Darwin, Hobart and Perth. All things being equal, rates of property price growth from late-2017 through to 2020 are likely to be higher than 2014 to 2016.

Sydney may remain completely flat for several years. Melbourne isn’t far from cooling and will soon be tested by the impact of direct and indirect job losses in the car manufacturing sector. The next few years won’t be as good for Canberra as the last few years, either. The tide has turned! As the growth cycle in Australia’s three most expensive capital cities comes to an end, the curtain is opening throughout the rest of Australia.

And the list of regional cities which have potential for superior total returns on investment than Sydney and Melbourne is indeed an extensive one. In alphabetical order, these include Albany, Alice Springs, Armidale, Ballarat, Bendigo, Bunbury, Bundaberg, Burnie, Busselton, Cairns, Devonport, Dubbo, Geraldton, Gladstone, Gold Coast, Griffith, Hervey Bay, Katherine, Launceston, Mackay, Orange, Parkes, Port Augusta, Port Lincoln, Rockhampton, Shepparton, Sunshine Coast, Tamworth, Toowoomba, Townsville, Wagga Wagga, and Whyalla. Propertyology is already helping our clients to invest in some of these locations at extremely affordable prices.

But, don’t expect the content that fills your i-device to alert you to the fact that property markets across much of Australia are showing continual improvement.

Australian media is notorious for having such a Sydney-centric focus. From 2013 to now, the media (falsely) reported that we were in the midst of a national property boom whereas the truth was that only Sydney (and to a lesser extent, Melbourne) was booming. So, for the foreseeable future the property media are likely to report Sydney’s anticipated prolonged flat spell as “…Australian property markets are dead”.

I’m anticipating that the 2018 property media will be dominated by an undertone of uninspiring property stories. Just remember, a majority of Australia’s journos (and economists) reside in Sydney – what happens in their neighbourhood is often reported as the national-state-of-play. If you’re interested in property markets be careful not to confuse reading with research. Mainstream media can’t be relied upon to alert you to the abundance of real opportunities elsewhere in Australia.

No boom lasts forever; for Sydney and Melbourne, it is over! Many Propertyology clients are still enjoying the boom which continues to evolve in Hobart. The rest of Australia hasn’t seen a property boom for more than a decade. But the immediate future does look somewhat brighter than the immediate past.

Here’s a summary of positive information which bodes well for the future of Australian property markets:

- To the year ending August 2017, Australian jobs grew by a significant 2.6%, including above-average growth in Tasmania (4%), Queensland (3.7%), and Victoria (3.2%);

- The federal government’s recent cuts to corporate tax rates is intended to encourage employers to create even more jobs;

- According to ABS data (August 2017 quarter) the industries which are producing the highest volume of job growth are healthcare, construction, education, accommodation-and-food (tourism), retail, agriculture, and transport. Parts of regional Australia are already seeing benefit;

- NAB’s Business Confidence Survey for September 2017 recorded its best reading in 9.5 years;

- The federal government recently announced that our national budget over the last year was $4.4 billion better than expected;

- Australia’s population growth of 126,728 for the quarter ending March 2017 was a whopping 14.8 per cent higher than the previous year and the second highest in our nation’s history (just behind the 132,807 in March 2008);

- The volume of people migrating interstate to both Queensland and Tasmania continues to increase each quarter and are currently at levels not seen since 2008 and 2010, respectively, while the volume of people leaving New South Wales continues to rise;

- Over the last 12 months, residential vacancy rates have tightened in Hobart, Canberra, Melbourne, Adelaide, Darwin and Perth;

- The volume of first home buyer transactions is picking up across most of Australia;

- House sale volumes increased over the last 12 months in Darwin, Hobart, Adelaide and Canberra, not to mention the dozens of regional locations;

- There is significant infrastructure investment planned in numerous major projects across the country, not just in capital cities. The long list of major job-creating projects includes renewable energy (wind, solar and hydro plants), new hotels, highway and airport upgrades;

- The federal government’s $200 billion investment in upgrading our defence force fleet is now being rolled out with dozens of manufacturing and maintenance contracts about to be awarded around Australia. Tens of thousands of new jobs will be created;

- Overseas visitors to the year ending July 2017 were up 8.1 per cent to 8.58 million people. The biggest year-on-year growth was in Canberra (+21.3%), Tasmania (15.9%), South Australia (10.5%), and New South wales (9.5%). Further growth is anticipated, especially with the exciting rise of Asia’s middle class;

- Stabilising commodity prices is already producing green shoots in our resources sector, especially in regional Queensland;

- International demand for Australian services (especially tourism and education) and our agriculture sector is strong. Free Trade Agreements with China, Japan and South Korea, combined with a low $AUD is likely to see demand continue to accelerate;

- National job advertisements increased by a spectacular 16 per cent over the year to August 2017. The most notable spikes were in Tasmania (+31.6%), Victoria (23.4%), and Queensland (21.1%).

- Interest rates likely to remain incredibly low for many, many years yet. With rental yields of circa 5 per cent readily available in Australia’s 5 most affordable capital cities and all regional cities, the annual cost for motivated property investors to hold a property is nominal.

Those who were fortunate enough to have benefited from the solid performance of Sydney and Melbourne’s property market over the last few years would be wise to do something with that equity. And you’d be just as wise to look beyond your home city.

All Australians would be wise to remind themselves that the scarcest commodity of all is time – we can’t manufacturer it. It’s always a good time to invest! The key question is not ‘when’ but ‘where’. It’s not all about Sydney and Melbourne.

Propertyology is a national property market researcher and buyer’s agency. The multi-award-winning firm’s success includes being a finalist in the 2017 Telstra Business Awards and 2016 winner of Small Residential Agency of the Year in REIQ Awards For Excellence. Managing Director Simon Pressley is a REIA Hall Of Fame Inductee and a three-time winner of the REIA and REIQ Buyers Agent of the Year award.