Consumers move prior to lockdown

The COVID-19 pandemic has simply accelerated the tree change that had started prior to the health outbreak, a leading researcher has told Smart Property Investment.

Research done for Smart Property Investment has revealed four hotspots in Victoria that were starting to grow prior to the COVID-19 pandemic.

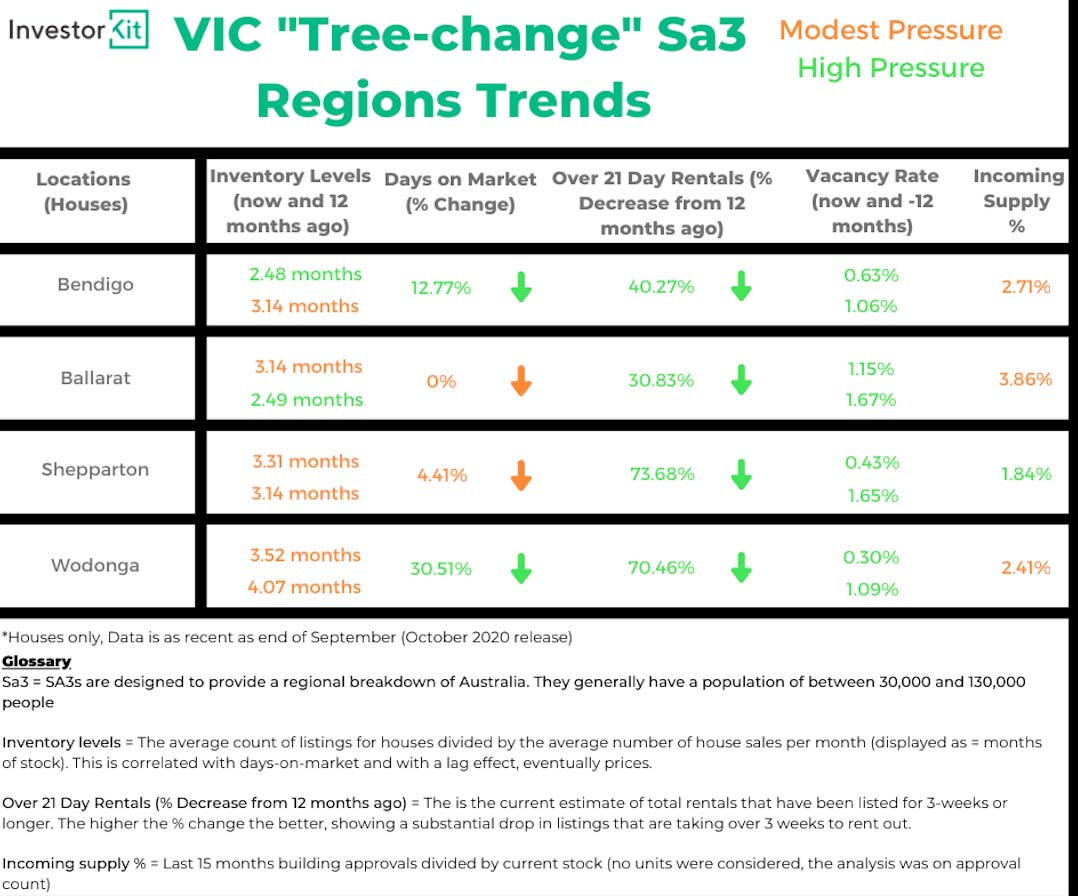

InvestorKit’s head of research, Arjun Paliwal, told investors that while these are just some of the major inner regions, all four regions are facing a rental crisis which could lead to higher rental yields for investors.

“Ballarat is the only one that is close to not being in one but three of the four have rates starting with a zero,” Mr Paliwal said.

Despite many assuming the major regional areas grew due to the COVID-19 pandemic with people trying to leave Melbourne, the researcher noted this trend was starting well before the virus.

“[The] tree change hasn’t happened because of COVID. The pandemic has just amplified it.

“The second part is, in comparison to new builds, more people are coming in, which means there’s not a lot of stock.

“We can see the strength of the rental market and the rental crisis that is happening because over 21-day rentals for all of these markets has decreased by 30 to 73 per cent,” Mr Paliwal said.

To put it in perspective, Mr Paliwal told investors that if 10 properties were available to rent this time last year, today a renter would be lucky to see five on the market.

While some of the tree change markets have begun to show signs of capital growth, Mr Paliwal told investors that rental markets are a forward indicator.

“Traditionally, it takes 12-24 months [to see capital growth],” Mr Paliwal said.

“The reason why is because it takes investors a little while to be attracted to an area.

“Although it’s not just the investors, often the renters get sick of rising rents and look to also get into the market as home buyers,” the researcher noted.

While explaining some of these tree regions are already experiencing capital growth with the change starting in 2017, investors could still see strong returns for each of these areas.

“While we expect these markets to continue their strength going into 2021, it is important to note that prior to COVID all of these markets had high pressure from a rental perspective and low stock level.”

“This means they are markets that are consistent with rental performance and price pressure that are likely to strengthen with the changes that COVID has structurally made,” Mr Paliwal concluded.