5 South Australian markets set to outperform in 2023

While South Australia was named the top-performing state across the country in 2022, there are five areas in the region that stood out from the pack.

A new analysis from buyer’s agency InvestorKit showed amid the housing downturn that swept the country in the previous year, South Australia’s property market did not only buck the trend but also delivered strong growth.

Data from CoreLogic showed Adelaide’s dwelling value experienced a notable increase of 10 per cent, while regional areas in the state witnessed an even more impressive surge of 17 per cent. These growth rates significantly outpaced those observed in other parts of the state.

Some of the factors that helped the region’s property market record strong growth include affordability, economic recovery, improvement in internal migration, and heavy infrastructure investment, according to InvestorKit.

Head of research and founder Arjun Paliwal said that while the state demonstrated strong gains in property values in general, there are pocket areas in the local market that “exhibited impressive performance since the beginning of 2022”.

In order to identify the standout performers in South Australia, the agency devised an evaluation system known as the Market Performance Score. This score, ranging from one to five, was assigned to each region and took into consideration several key factors.

After crunching the numbers, InvestorKit revealed the top five performing markets in the state, which included Barossa, Mount Gambier, Tea Tree Gully, Onkaparinga, and Adelaide Hills.

“The top five regions have displayed robust economic growth, with high gross regional product (GRP) growth and historically low unemployment rates that have remained at their lowest level in the past 10 years.

“They have demonstrated exceptional performance in the preceding year, and based on their economic and property market indicators, it is expected that they will continue to outperform in 2023,” Mr Paliwal explained.

Below is a closer look at the top five South Australian regions, according to InvestorKit:

1. Barossa (Market Performance Score: 4.5)

With an average house price of $465,000, Mr Paliwal highlighted Barossa’s residents “enjoy the luxury of low cost of living and high quality of life”.

Over the past year, the market has experienced significant growth in median house prices, with an increase of 13.5 per cent. Looking at a broader time frame, over the course of the last decade, the market has seen even more substantial growth, with a staggering 47.8 per cent rise in median house prices.

“Although the sales volume is slowly trending down and the price is not growing as fast as last year, we do not see its growth stopping anytime soon considering the high market pressure and affordability,” Mr Paliwal stated.

With just 16 per cent of properties in Barossa available for rent, the dominant owner occupancy has created a highly competitive rental market. Vacancy rates have remained incredibly low, hovering at around 0.1 per cent.

Rent levels have been surging as a result of the rental crisis, keeping rental yields at a healthy level of 4.5 per cent. This has led to a strong rise in median rents over the last 15 months, with rents having grown by a total of 46.4 per cent over the decade.

2. Mount Gambier (Market Performance Score: 4.7)

Mount Gambier, the second-largest city in South Australia, occupies a strategic position between Melbourne and Adelaide.

In early 2022, the city witnessed a surge in its median house price, but it still currently stands at an affordable $380,000. Over the past 12 months alone, the median house price has experienced a substantial increase of 26.7 per cent. Looking at the broader picture, the median house price in Mount Gambier has risen by an impressive 61.7 per cent over the last decade, aligning with the long-term average growth.

Over the past decade, Mount Gambier has observed a consistent downward trend in rental vacancy rates, hitting its lowest point in 2022 at 0.5 per cent.

The heightened market pressure has led to robust growth in rental prices, resulting in a steady rental yield of 5 per cent. Throughout the decade, rents in the city have seen substantial growth, amounting to a total increase of 48.9 per cent.

3. Tea Tree Gully (Market Performance Score: 4.0)

While Mr Paliwal acknowledged Tea Tree Gully is “currently slightly overvalued” with a median price of $620,000, he highlighted the market is still relatively affordable compared to many other Adelaide subregions that offer similar facilities and lifestyles.

Despite experiencing a staggering 42 per cent surge in the past two years, the average house price in the Tea Tree Gully remains lower than that of Greater Adelaide, which stands at $645,000. This growth rate is significantly higher than Adelaide’s average increase of 31 per cent.

Tea Tree Gully has an incredibly tight rental market with a 0.2 per cent vacancy rate. However, rents have been growing robustly, restoring rental yields to a healthier 4 per cent level after a decline caused by rising sales prices.

“Tea Tree Gully stands out in Greater Adelaide with a good mix of strong economy, relative affordability, lifestyle, and growth prospects,” Mr Paliwal noted.

4. Onkaparinga (Market Performance Score: 4.0)

Boasting a median house price of $575,000, Onkaparinga is one of South Australia’s most affordable markets, a factor Mr Paliwal noted has helped the region grow steadily in the past year even under hiking interest rates.

Over the past 12 months, the median house price has increased by 16.8 per cent, and in the past 10 years, a total of 74.8 per cent.

Commenting on the region’s economic prospects, Mr Paliwal said: “The region’s unemployment is not the lowest in Greater Adelaide but has improved a lot in recent years, and now sits at the lowest level in a decade. The $5.4 billion worth North-South Corridor is set to further boost the local economy by creating thousands of jobs and business opportunities.”

As with other entries in the list, Onkaparinga’s rental market has also been under increased pressure, with a vacancy rate hovering around 0.1 per cent for a year. Rent levels surged as a result, and investors can enjoy a healthy 4.3 per cent and improving rental yield.

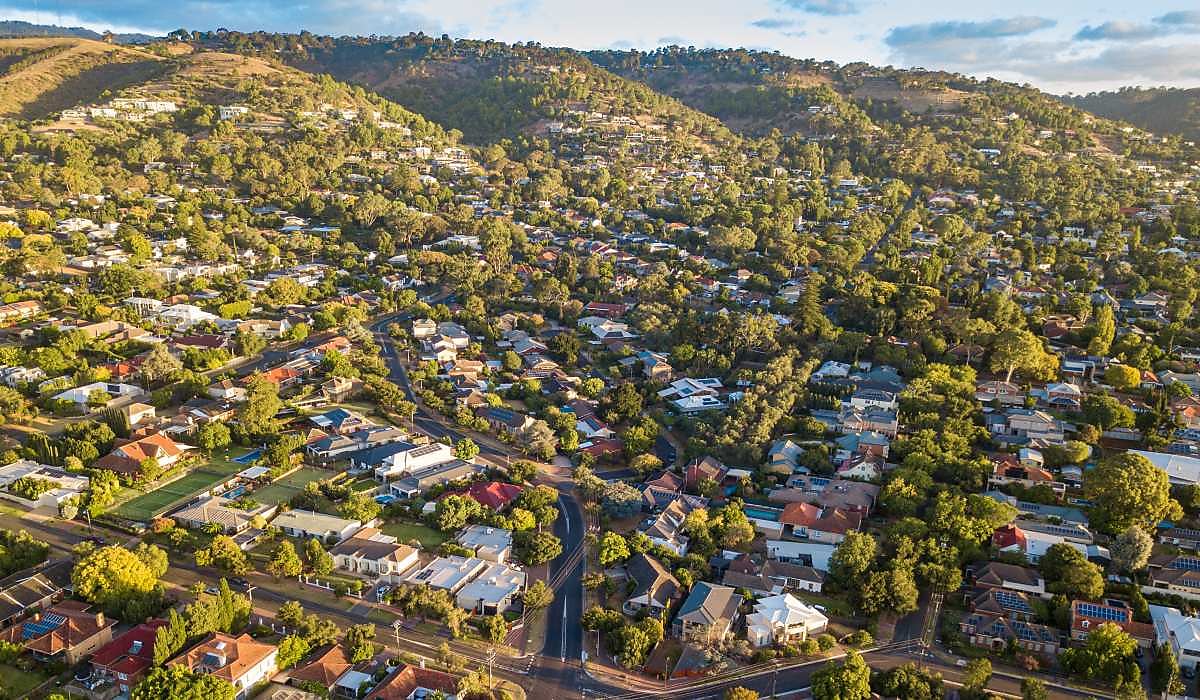

5. Adelaide Hills (Market Performance Score: 4.0)

In recent years, the Adelaide Hills region has emerged as one of the standout performers within Greater Adelaide.

The median house price in the area has been steadily rising since 2021, with a notable increase of 15.6 per cent over the past 12 months, reaching a current value of $651,200. Over the span of a decade, the median price has experienced significant growth, surging by 58.8 per cent.

Based on current trends, Mr Paliwal forecast Adelaide Hills would continue to demonstrate a similar growth rate in the next decade.

The rental market, just as many other Adelaide regions, has been extremely tight over the past two years, with vacancy rate now sitting at 0.3 per cent. Investors can expect a healthy yield of 4 per cent, with rents having grown by a total of 40.8 per cent over the past decade. Rental growth is expected to continue under this high pressure.