Brisbane market update July 2024

Brisbane’s property market continued to rank among the top-performing capital cities in terms of price growth throughout July.

As in previous months, attached dwellings in Brisbane have outperformed detached homes.

You’re out of free articles for this month

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

There is strong demand for well-located units and townhouses, as well as houses priced around the city’s median value. While buyer activity does taper off somewhat at the higher end of the market, the limited availability of stock means there are still more buyers than sellers, regardless of the property’s price point.

It’s becoming increasingly clear that buyers are exercising more caution, yet the fast pace of the market is making many feel like they’re being left behind. Sellers remain in control, often holding out for premium prices, which are sometimes paid by buyers who have been searching for a while and are eager to secure their next home.

In July, new listings in Brisbane rose by 5.15 per cent compared to the previous month, according to SQM Research, while total listings increased by 2.87 per cent. Compared to the same period last year, new listings were up 9.31 per cent, but total listings decreased by 4.16 per cent. CoreLogic data also shows that sales volume in Brisbane grew by 8.8 per cent over the past year.

Despite the increase in sales, the longstanding supply issues in Brisbane remain. In July, there were 16,984 properties listed for sale, significantly below the monthly average of over 30,000 listings seen in 2019 and earlier years. This ongoing supply constraint continues to drive up property values.

Long-term supply data reveals a spike in dwelling approvals for May, according to the Australian Bureau of Statistics (ABS) figures. However, there are concerns about whether this will be sufficient to meet housing demand.

In May, Queensland saw a 6.3 per cent increase in total dwelling approvals, but this rate still falls short of meeting the national cabinet’s goal of building 1.2 million new well-located homes over the next five years, beginning on 1 July 2024. It is anticipated that new construction will not be sufficient to meet the demand in Brisbane in the near future.

Recent legislative changes by the Queensland government have affected rent increases, impacting investors across the state. Landlords are now prohibited from increasing rent on a new lease for a specific property, if it was raised less than 12 months ago. This regulation means that rental price hikes more frequent than every 12 months are no longer allowed in Queensland, regardless of circumstances or the ownership status of the landlord.

Legislative changes like these may have played a role in the recent trend of landlords selling off their properties. Data from Suburbtrends shows that in several areas, a significant proportion of the properties listed for sale during the 2024 financial year were previously rental properties. For example, in postcode 4031, which includes Kedron and Gordon Park, 35 per cent of the listings were ex-rentals. Similarly, 34 per cent of the properties listed in postcode 4059, covering Kelvin Grove and Red Hill, were former rentals. In postcode 4114, which includes Logan Central, Woodridge and Kingston, 34 per cent of the listings were also reported as ex-rental properties.

While sales trends like this may have been evident in some locations over the last 12 months, investors in Queensland still appear to be very active on the buy side, as indicated by an increase in lending for investment purposes. ABS lending data shows that 39.1 per cent of housing finance commitments in Queensland are for investment, suggesting ongoing optimism about the state’s prospects.

Auction activity remains strong, with an average of 3.1 bidder registrations per auction and 63.6 per cent of those registered actively participating. Although auction clearance rates have slightly decreased – from 64.8 per cent in June to 61.8 per cent in July, according to Apollo Auctions –there are still more than one buyer per property. This persistent demand relative to supply continues to put upward pressure on prices in Brisbane each month.

Dwelling values in Brisbane July 2024

In July, Brisbane’s dwelling values increased by 1.1 per cent, showing a slight slowdown from June’s growth rate of 1.2 per cent. Over the past quarter, growth for all dwellings in Greater Brisbane has been 3.8 per cent. The median dwelling value in Greater Brisbane has hit a new peak of $873,987, rising by $14,667 from the previous month and $33,211 from three months ago.

Source: CoreLogic

PropTrack data confirmed the same trend, with 0.34 per cent dwelling price growth reported throughout July.

Source: PropTrack

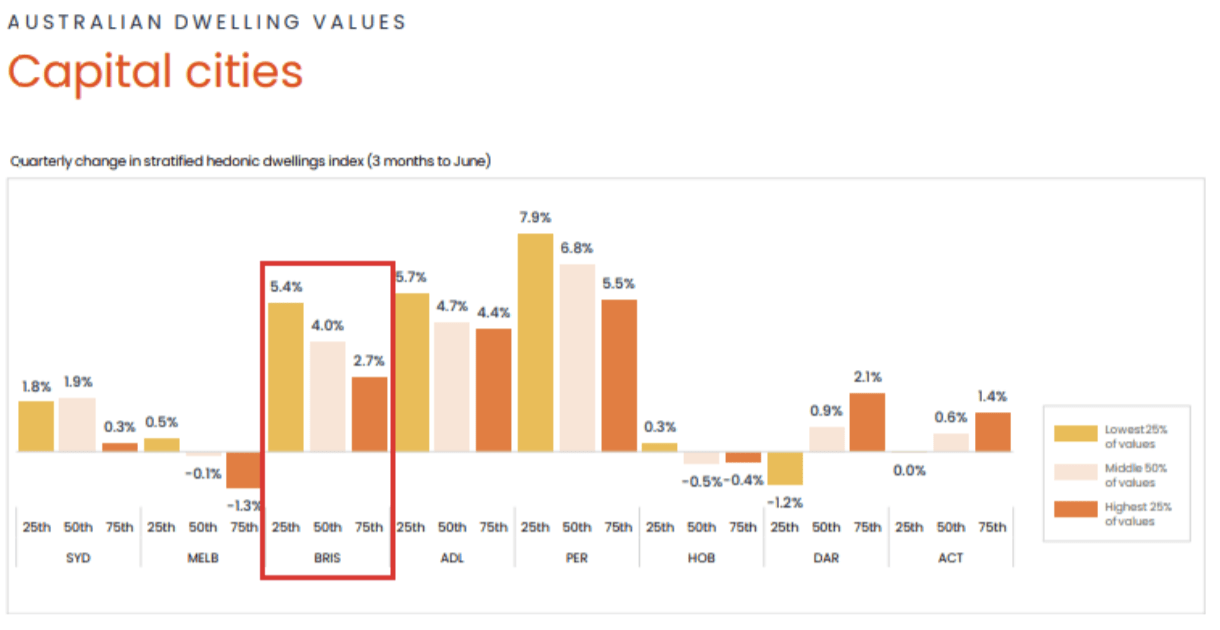

Like most other capital city markets, except Darwin and Canberra, Brisbane’s upper quartile has experienced slower growth in dwelling values over the past three months. Last month, the growth rate for the top 25 per cent of property values was 3.2 per cent quarterly, but this has now decreased to 2.7 per cent. In contrast, the lower quartile, which includes more affordable properties, has seen stronger growth, increasing from 5.3 per cent last month to 5.4 per cent this month. This trend is also reflected in the stronger performance of unit values compared to house values in Brisbane over the last quarter.

Source: CoreLogic

Over the past 12 months, dwelling growth in Brisbane has been highest in the Ipswich, Logan and North Brisbane Statistical Area Level 4 regions. Ipswich and Logan, being more affordable markets, reflect the broader price trends across Greater Brisbane. This strong growth may be due to rising investment in these areas, often driven by investors from outside the region, which can push property prices to levels that become unaffordable for local buyers. This situation increases the risk of a downturn, particularly if investment activity decreases in the future.

Brisbane house prices July 2024

In July, median house prices in Brisbane rose by 1 per cent, a slight slowdown from the previous month’s growth rate of 1.1 per cent. Over the past three months, quarterly house growth stands at 3.4 per cent.

On an annual basis, Brisbane remains the second fastest-growing capital city market in Australia, with a 15.2 per cent increase in values. The current median house value in Greater Brisbane is $966,825, up by $13,797 from last month and $32,872 from three months ago. Over the past year, the median value of houses in Brisbane has increased by $146,957.

Source: CoreLogic

PropTrack data also confirms this trend, with 0.3 per cent growth in house values for July reported.

Source: PropTrack

Brisbane unit values July 2024

Unit price growth in Brisbane continues to outpace house price growth throughout the city. In July, CoreLogic data recorded a 1.9 per cent increase in unit prices, with quarterly data showing a 5.8 per cent rise.

On an annual basis, unit prices in Brisbane have surged by 19.6 per cent. The median value for a unit in Greater Brisbane is now $638,909, up $16,342 from last month and $37,056 from three months ago. Over the past year, the median unit value in Brisbane has grown by $125,226.

Source: CoreLogic

PropTrack data also confirms that unit price growth in Brisbane throughout July outperformed house price growth showing a positive 0.5 per cent lift in values.

Source: PropTrack

Rental market in Brisbane July 2024

Brisbane’s rental market remains tight, with a vacancy rate of just 1.1 per cent. The low supply of rental properties has driven up rents, especially as demand for rentals continues to rise.

For the first time since 2020, Brisbane saw a slight monthly decrease in rents (-0.1 per cent). Over the past year, unit rents have dropped by more than 8 per cent in their annual growth rate, possibly due to slower rates of overseas migration, leading to a slight decrease in tenant demand.

However, despite this, the current annual growth rate of 7 per cent for both house and unit rents in Brisbane remains significantly above the long-term average, highlighting the ongoing imbalance between rental supply and demand across the city.

Source: CoreLogic

Interestingly, larger rental properties in Brisbane are experiencing stronger rent price growth, even though they come with higher costs. For renters in shared living situations, such as group households or multigenerational families, houses with five or more bedrooms and units with four or more bedrooms may actually be more practical and affordable options.

Gross yields in Brisbane are continuing to tighten, with house yields at 3.5 per cent and unit yields at 4.7 per cent. Investors are finding it increasingly challenging to identify cash flow-positive properties across the city without significant cash deposits, due to higher holding costs and lower gross yield targets.

Summary

Housing affordability in Brisbane is undoubtedly becoming more challenging, especially in suburbs where property values have risen much faster than incomes, and where baseline incomes are already below average. This is likely a reason why some buyers are making compromises, such as purchasing homes farther from their workplaces or opting for smaller, attached homes in more convenient locations rather than detached ones.

Given the significant price growth Brisbane has experienced in recent years, it’s essential for buyers, particularly property investors, to be cautious when choosing a location. In areas where local buyers are priced out and investors are driving prices up, there’s a risk of increased market volatility in the future.

That said, there are still many suburbs in Brisbane where affordability remains intact, and these areas could see continued price growth, pushing the median value across Greater Brisbane even higher.

With the Queensland state election just three months away, housing is likely to become a key focus for major political parties. The Real Estate Institute of Queensland (REIQ) has proposed bold housing reforms to address the home ownership crisis and rebalance the rental market. Any policy changes could impact property markets and their future trajectory, so this is something all Queenslanders will be watching closely.

Given Queensland’s strong economy, particularly in the south-east corner, it’s no surprise that Brisbane is a top target for both property investors and home buyers. Population growth remains robust, unemployment is low, and with more stable interest rates, there’s now a level of certainty that will help support property values in the months and years ahead, despite any challenges.

Buyers who have been waiting for the Brisbane property market to slow down may be disappointed. Current conditions suggest that we’ll continue to see gradual and consistent price increases across the city. It’s never too late to enter the market, especially if you’re seeking a high-quality property that is likely to outperform others over the long term.

Melinda Jennison, managing director at Streamline Property Buyers.