Does ‘blue chip’ guarantee a greater return?

Promoted by Pure Property Investment

With the recent data showing a distinct slowing of the Sydney property market, I thoughts it would be timely to take a rear vision snapshot of the performance of the greater Sydney market over the entire growth cycle between 2012 and 2017…

If you are a residential property investor the chances are that you are parked in one of two camps being:

- Buy affordable and focus on a blend of cash flow and capital growth

OR

- Buy ‘blue chip/ ‘green chip’ and sacrifice some cash flow for greater propensity for capital growth

At www.purepropertyinvestment.com , we have a very strong focus on the driving property market fundamentals for capital growth and cash flow which you can learn more on via the following link https://free.purepropertyinvestment.com/invest-strategically-webclass

Whilst there is no shortage of commentary out there to support both trains of thought. Given the current slowing in the performance of the Sydney property market, its a great time to compare several ‘more affordable cash flow markets’ and historical ‘blue chip’ markets and their performance over the growth cycle between 2012-2017. In this comparison, we have factored in a starting position of $60,000 deposit assuming a 10% deposit plus closing cost then assessed what was the amount could buy in each market respectively. We have then compared the returns which would have been achieved across multiple markets. The results may surprise you.

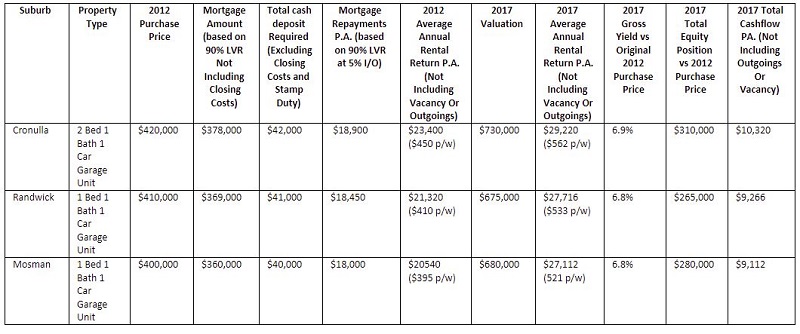

Let’s start with looking at the performance of some of the more well-known Sydney blue chip markets over the past 5 years including the growth and cash flow.

Now, let’s compare these markets to the more ‘affordable’ corridors of South West and West Sydney over the past 5 years including the growth and cash flow.

From our perspective, the key take home messages from the above 5-year analysis from the Sydney market is to ensure that as a strategic and pragmatic property investor you must look at what’s ahead, rather than what is in the rear-view mirror.

Whilst the listed ‘blue chip’ properties have performed well and the return has been sound. The lesser thought of ‘affordable corridors’ the past 5 years have outstripped many of their more prestigious and far more expensive ‘blue chip’ markets when you compare capital growth along with cash flow/ rental yields.

The reasons why are not complicated, its supply and demand. In the past 5 years the West and South West Sydney markets have seen a consistent demand and population growth position with some key larger scale infrastructure projects having been announced/ or commenced along with record low interest rates, sound employment figures and restricted supply. Remembering that that our fundamentals for capital growth and cash flow Webclass will provide some of the key insights all investors need to consider when you are planning on buying your next investment.

For any investors looking to buy their next investment, the above case study is a ‘point in case’ visual overview as to why the focus need to be on not what has happened in the past, but what is happening in the future.

Happy hunting…