How construction finance works

When entering into a building contract you should check that the contract has a condition that allows you to make every reasonable effort to get finance by a specific date, so that if you are unable to get finance the contract will not proceed.

When entering into a building contract you should check that the contract has a condition that allows you to make every reasonable effort to get finance by a specific date, so that if you are unable to get finance the contract will not proceed.

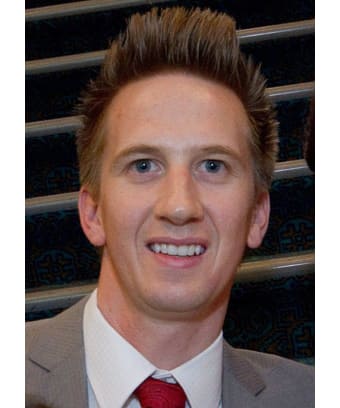

Blogger: Darren Standish, Property Prosperity

It is important that you take the time to ‘shop around’ for a lender before you enter a building contract. An experienced Mortgage Broker will be able to assist you to ensure the best possible lender for your requirements.

There is an important difference between getting a loan to build as opposed to a loan for an established property. When you employ a builder, you agree to pay the builder by instalments (called progress payments) depending on specified building milestones being achieved. Usually, you will only pay interest on the amount of the progress payments that have been paid to the builder, not the total amount of the loan.

So, until the final progress payment is made, you will generally only pay interest on the amount of money actually paid to the builder.

There are a number of ways you can organise your finance for building however the most common way is to extend the existing loan for land to finance the construction of your house

In today’s financial market the maximum amount extended for new dwelling construction is approx 95% of the total construction cost. This means that if your house cost $200,000 to build you would be required to contribute $10,000 to the construction cost from your own cash reserves.

It should be noted that a considerable saving can be made on stamp duty when constructing a new home compared with purchasing an existing home since stamp duty will only be paid on the land not on the construction of your new home.

For example if you bought a block of land for $200,000 and build a house for $200,000 you would only pay stamp duty on the land (approx $10,000). Whereas on an existing $400,000 house you would pay stamp duty on the full purchase amount (approx $20,000)

Another major benefit existing for first home buyers when building a house is that they may be eligible for the First Home Buyers Grant (FHOG). The FHOG is currently $15,000 for newly constructed dwellings.

About Darren Standish

Darren Standish established Property Prosperity in 2004 initially as a property development company, however after repeated requests for assistance the business evolved into a development consulting business.

Property Prosperity was initially focused on assisting clients with subdivisions and negotiating with councils to ensure that clients maximized their return on investment. Over the years additional services were gradually added to ensure the development process was as seamless as possible for its clients. We expanded into offering individually tailored finance solutions and then added Property Development Analysis, Property Sales and a Builder Broker Services.

Darren is the overachiever of the team and has more qualifications than your average university graduate. As well as completing a Bachelor in Economics, Bachelor in Commerce and post graduate in Accounting he subsequently went on to complete a Diploma in Financial Service, Diploma in Real Estate and Certificate IV in Building. He is a qualified Certified Practicing Accountant (CPA), a licensed Real Estate Agent, licensed Mortgage Broker and holds a Builders License.