CASE STUDY: Investment Property For An Extra $50/week

Promoted by Mortgage Corp

A single income family refinanced home loan to purchase their 1st investment property and only paid an extra $50 per week in mortgage repayments.

Executive Summary

A single income family refinanced home loan to purchase their 1st investment property and only paid an extra $50 per week in mortgage repayments.

Overview

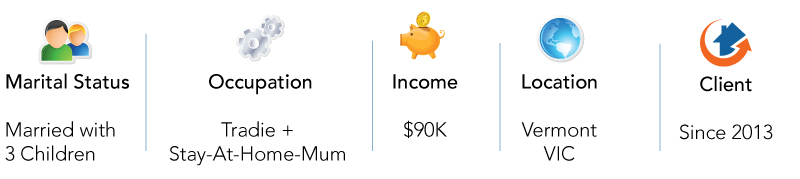

Client: James and Robyn, Client of Mortgage Corp since 2013.

Marital status: married with 3 kids

Income: Single income approx. $90K per annum

Occupation: Employed tradesperson + stay at home mum

Suburb of home: Vermont, 3133 VIC

Suburb of investment: Wantirna, 3152 VIC

Objective: purchase their first investment property to set them up for their future

Client Background

James and his family wanted to set themselves up for the future by buying their first investment property. He was a tradesperson earning $90,000 a year, married with 3 kids, living in Vermont in the eastern suburbs of Melbourne.

James had always wanted to buy an investment property because he wanted to be able to maintain their lifestyle after retirement and also have some passive income (rental income) in the future.

With Robyn being a stay-at-home mum with 3 young kids, they didn’t think they could afford another property.

The Challenges

- High interest rate on his existing mortgage was eating into his cash flow

- He didn’t have enough deposit for an investment

- He was a single-income earner with a large young family with a lot of financial responsibilities

Objectives

- Buy an investment property with good rental income and long term growth

- Reduce interest on the mortgage on his existing home

- Be able to maintain their current lifestyle

The Solution:

Through a friend, James met Neil, Mortgage Corp’s loan strategist. After the Free Loan Strategy Session, Neil explained to James and Robyn how they would be able to buy an investment property through refinancing their home loan

We refinanced their existing home loan and reduced their interest rate by 1% (from 4.85% to 3.85%) through our access to premium broker rates.

We worked out that after refinancing, they could actually afford to buy an investment property and would only pay between $150 to $200 a month more than what they were already paying on their home loan. Whilst James was earning less than $100,000 and had a big family to support, he had family benefits to help him and it was also expected that the investment property he bought would generate around $550-$600 per week in rent.

We also assisted James find the right property with access to free property reports that gave him an indication of the likely value based on recent sales in the area, as well as information about the growth potential in the suburb.

Based on our property data, we suggested James to look at growing suburbs east of Melbourne CBD with good investment opportunities such as Ringwood, Wantirna, Ferntree Gully.

After a few inspections and enquiries, James and his family ended up focusing their search in Wantirna. Whilst not a very large suburb, our property reports showed that the Wantirna had a high number of older owner-occupier residences, mainly from the baby boomer generation who were parents of adult children and who were using their equity or capital growth in their home to help their children purchase their first homes. This was due to the high capital growth seen in the area since 2014, with growth of 14.1% in 2015, which saw average home prices in Wantirna rise from around $720,000 up to nearly $900,000.

Sources: RP Data Property Report 2017

Results

- Secured a quality investment property by paying less than $50 extra per week (after rent)

- Lowered the interest rate on his existing home loan, by nearly 1%. The reduced rate on their home loan meant they were able to have a home and an investment property.

- Maintained their current lifestyle

- Worked out a plan to pay down their mortgage and will review the loans in a couple of years for new investment opportunities

Note: for privacy reasons, names used in this case study are not real client names or locations.

Mortgage Corp Client Testimonials

For Mortgage Corp customer reviews, visit

www.mortgagecorp.com.au/testimonials/ or

https://www.facebook.com/mortgagecorp/reviews/

What’s Next?

Keep reading 5 Little Known Strategies Successful Investors Use To Build A Solid Property Portfolio