Will my investments drown if I buy in Queensland?

For those looking to invest for the future, the first thing many do is go to banks or finance brokers to understand if they can borrow. If they can, what most people will do is to head out the door and spend it all without doing any research.

What they don’t understand is how this will impact them. What type of property should they purchase? Where should they purchase? How much will it cost them to hold the property each week? What local conditions will impact them?

Let’s take a look at the Queensland market in particular, where cyclones and flooding rains can have your property damaged or flooded potentially costing you thousands of dollars, but there are ways to mitigate your risks. Especially if you are strategic and smart about how you approach your investing.

Many of you will remember the terrible flash floods at the end of 2010 where Toowoomba, Lockyer Valley, Ipswich and Brisbane experienced severe flooding. Only a couple of short months later, more of Queensland then went on to experience the devastation of Cyclone Yasi.

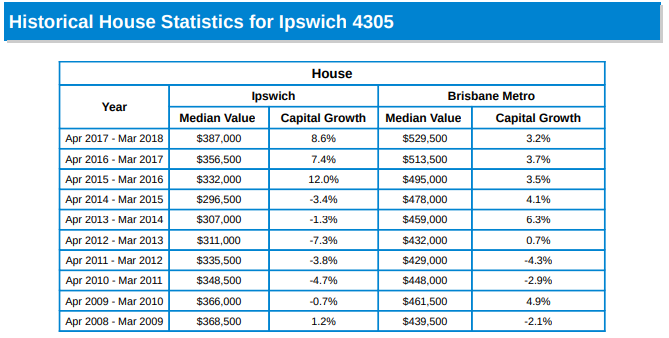

If we look more closely at Ipswich, we can see the impact of these floods with negative growth in six years out of the past 10.

Taken from Residex Suburb Statistics Report: Ipswich

Can you imagine if you made a purchase here during 2009 for $366,000 and today 10 years on, it is still only worth $21,000 more? If it was flooded and you had huge out-of-pocket expenses to get it back to a liveable dwelling, can you imagine the pain you will have to go through? With no rent coming in but the mortgage still needing to be paid, it can put investors in a lot of pain. I am sure that many investors may have lost thousands of dollars on an investment here.

Good investments are still possible

But are they all poor investments in these areas? The answer is a resounding NO. You will need to complete extreme due diligence in the area prior to making a purchase here. Many councils now have extensive flood mapping. You can ascertain, street by street, the areas to avoid as they are more prone to be impacted by flooding than others.

Useful tips

Local property managers who have been in the area over the past 10 years will also be a wealth of knowledge as to which homes may have been inundated. This, in turn, may make the property harder to rent and/or sell should the need arise.

I would also suggest completing research with an insurance broker to understand the cost of building insurance, which could be huge. We have heard clients stating that they have received quotes of $5,000 just for insurance in flood prone and cyclone areas. Whereas, a purchase in an area that is not subjected to these types of events may have a building insurance of only $1,000 to $1,500. Costs like this can create havoc with your cashflow.

One final tip would be to research how long a property in this area has been on the market along with historical sales. It could be a dead giveaway if a property has been on the market for, say, 400 days and not sell to then be relisted a couple of years down the track. This raises some red flags to then dig deeper into the reasons why.