It’s all downhill from here: Property price growth to drop drastically from 2022

With the worst of the pandemic seemingly behind us, bankers are now predicting 15 per cent price growth for Australia’s housing market this year, before macro-prudential measures dramatically slow growth early next year.

Citing high clearance rates, a surge in housing construction and consistent price growth, Westpac is no longer referring to market activity as a post-COVID rebound. Instead, in its latest housing pulse report, the bank has upped its price growth predictions for this year from 10 per cent to 15 per cent.

“Australia’s housing markets are fizzing. The broad–based lift that was gathering three months ago is now a fully fledged boom,” said Westpac senior economist Matthew Hassan.

But it’s next year’s forecast that has caught pundits off guard, with Westpac revising down its earlier strong growth prediction to a slim 5 per cent in 2022, before the market completely stalls in 2023 with 0 per cent growth.

According to the big four bank, affordability and macro-prudential measures will play a key role in slowing the market from here, with supply and demand factors also expected to come to play as a result of border closures.

In fact, Westpac is confident the Reserve Bank will move to slow growth in the first half of 2022 with a change in prudential policy.

Noting clear intention from the RBA to act, Westpac pointed to the bank’s latest monetary policy decision statement in which it said it was moving into “watching closely” mode.

“Given the environment of rising housing prices and low interest rates, the bank will be monitoring trends in housing borrowing carefully, and it is important that lending standards are maintained,” the RBA said in May.

This, Westpac judged, is a step up from the RBA’s April general comments when it characterised lending standards as “sound”.

On the other hand, Westpac’s research found that although issues around affordability are beginning to weigh on owner-occupiers’ willingness to buy, a further pickup in investor activity is expected, which is essentially what is seen to keep driving the market forward.

It does, however, foresee other issues, such as a shift in the physical supply-demand balance following a prolonged period of external border closures.

Westpac noted that with net migration projected to not just fall but swing into a net negative, annual population-driven demand for new dwellings will be sent into a downward spiral. This, the bank predicted, will likely see what was a small stock deficiency in 2020 disappear in 2021 with a modest overhang emerging in 2022.

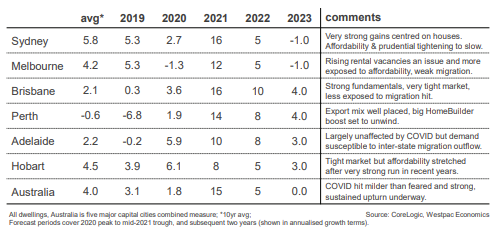

Price movements in each capital city

According to Westpac, the cities set to feel the brunt of next year’s property contraction are Sydney and Melbourne, where this year’s strong growth is expected to swing into the negative by 2023.

In fact, Sydney and Melbourne will see their strong 2021 growth of 16 and 12 per cent, respectively, slow to 5 per cent in 2022, before the market contracts and experiences a 1 per cent drop in 2023.

Brisbane and Perth, however, are expected to enjoy ongoing growth, albeit at a slower pace.

Westpac’s growth predictions are as follows: