Brisbane bucks the national trend as property price growth accelerates

Brisbane is bucking the national trend once again, with the monthly pace of property price growth across the housing and unit markets accelerating in July. Buyers are out and stock is low, and this is fuelling the upward price pressure across many parts of the city.

With interest rates holding firm for two consecutive months in June and July, and inflation coming down to levels that were lower than expected for the June quarter, it’s looking increasingly likely that the interest rate cycle is at or near its peak. This could help to improve consumer confidence in the months ahead. Even with consumer sentiment levels staying as low as around GFC times, buyer demand has been increasing in Brisbane over recent months. It’s been an unexpected trend.

Whilst other markets around the country are seeing price growth easing, this is not the case in Brisbane. Also other markets are experiencing a significant rise in the number of fresh listings added to the market. Again, this is not the case in Brisbane.

SQM research shows that new listings between June and July increased 2.6 per cent across Brisbane, however total listings declined 6.15 per cent. This confirms that buyers are also looking at properties that have been on the market for more than 30 days. This is perhaps the result of circumstances when properties fail to sell quickly due to sellers’ expectations being ahead of the market more so than a lack of a buyer’s willingness to purchase.

Source: SQM Research

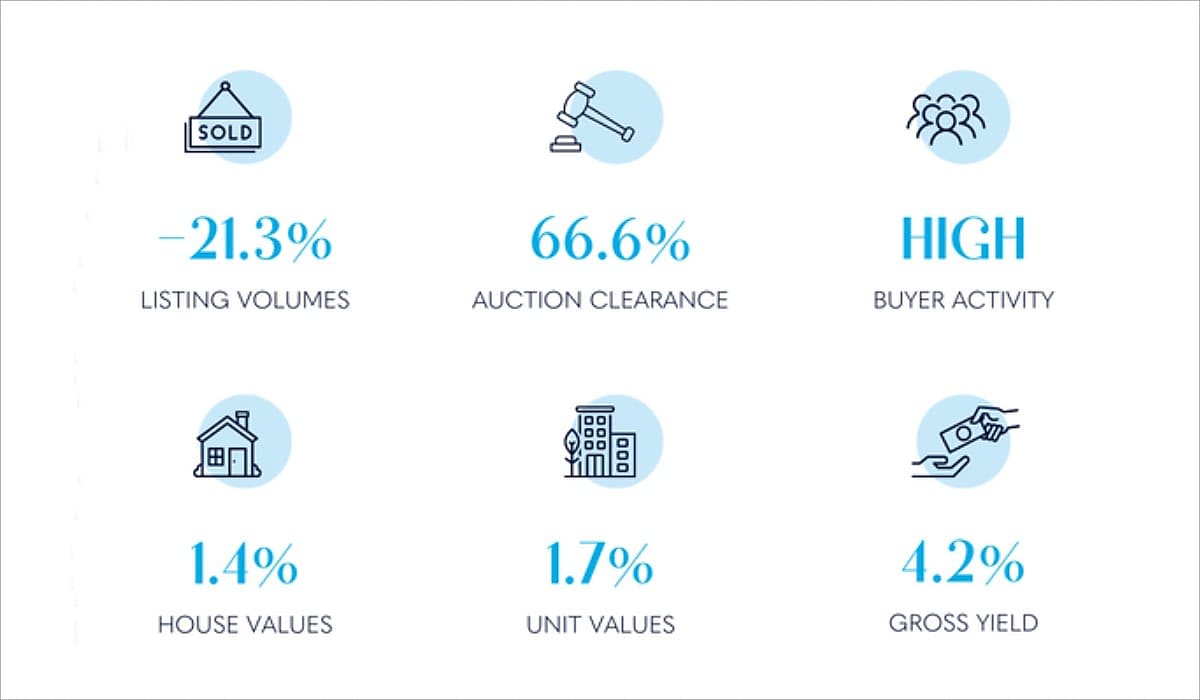

Compared to this time last year, Brisbane’s stock is still very low with 25 per cent fewer new listings and 21.3 per cent fewer total listings according to CoreLogic. This contrasts with Sydney, for example, where new listings are up 9.9 per cent compared to a year ago and is evidence of the fact that each market needs to be examined by its own supply and demand metrics.

Demand is much higher is suburbs closer to the CBD than in areas further out. According to the number of views on realestate.com.au per listing, for three- and four-bedroom houses the highest demand is in suburbs including West End, East Brisbane and Grange – all inner-city locations. The lowest demand, based on views per listings for three- and four-bedroom houses, is in suburbs including Shorncliffe, Inala, Sunnybank and Logan Reserve, which all happen to be a little further out.

For two- and three-bedroom units, the highest demand is also in the lower density inner-city locations such as Graceville, Petrie Terrace and Gordon Park. The lowest demand is in areas further out including Darra, Wynnum West and Moggill. This data shows a similar trend to the house data whereby inner-city locations are attracting more views per property, which often translates to more inspections and more offers or bidders. Demand creates price pressure, and this supports the price segmentation data by CoreLogic showing a trend in which the highest 25 per cent of property value in Brisbane has been growing at a faster rate than the lowest 25 per cent of property value over the most recent months.

Auction clearance rates in Brisbane held firm at 66.6 per cent throughout July, according to Apollo Auctions data. This is very similar to June (65.05 per cent) and May (66 per cent). We are seeing a gradual decline in the average number of registered bidders per auction. In May, there were, on average, 3.9 registered bidders per auction, then 3.7 in June; and throughout July we saw this number drop to 3.5. However, the number of registered bidders who raise their paddle during an auction has remained firm with 63.4 per cent bidding in July compared with 63.9 per cent the month prior.

Dwelling values

Growth in Brisbane dwellings has accelerated again throughout July, after losing some momentum in June. CoreLogic data confirmed Brisbane dwellings grew 1.4 per cent throughout July, placing he current median at $735,394, which is $9,997 more than last month.

Source: CoreLogic

Home prices in Brisbane rose 0.37 per cent in July to hit a new price peak according to PropTrack. After rising for seven consecutive months, Brisbane has now regained 2022’s price falls in entirely. According to PropTrack, Brisbane dwelling prices are now 1.98 per cent above their levels a year ago.

Source: PropTrack

House Values

The housing market gained momentum again in July with a 1.4 per cent increase in the median value across the month. The current median house value in Brisbane according to CoreLogic is $819,832, which is $13,051 more than last month. Quarterly growth in Brisbane is now second behind Sydney, when comparing all capital cities in Australia. It’s important to note that the momentum of price growth in Sydney has reversed, however this is not the case in Brisbane.

Source: CoreLogic

PropTrack data also demonstrates another month of positive price growth in Brisbane housing with a 0.36 per cent increase in median values recorded over the last month.

Source: PropTrack

Unit values

Unit values in Brisbane have reached a new record high, with a big jump in median value across the month of July. Units experienced a 1.7 per cent price shift which places the current median value at $520,346, the highest it has ever been, and $8,084 more than just one month ago.

Source: CoreLogic

PropTrack data also confirms positive price growth in the unit market in Brisbane throughout July with 0.46 per cent growth in median value recorded.

Source: PropTrack

Over the last 12 months, Brisbane’s unit market has outperformed its housing market in terms of price growth. This trend is evident regardless of which data set we rely upon.

In the most recent three months, however, CoreLogic data shows that the housing market is showing signs of faster growth based on quarterly growth figures. Houses are up 4.2 per cent, whereas units are up 3.8 per cent. Regardless of this, both market segments have been in positive growth territory for the last five consecutive months which demonstrates the strength that we have been seeing in the Brisbane property market in recent months.

Rental market

CoreLogic data shows that units in Brisbane are a standout, alongside Perth and Melbourne, with the fastest rate of rental price growth over the rolling quarter. Unit rent prices in Brisbane have grown 3.8 per cent in just three months.

The annual change in Brisbane unit rents is +15.8 per cent, whereas for houses the annual change is +7.7 per cent. This indicates that the demand for units is still higher in the rental market, which is continuing to put upward pressure on prices in an environment where the supply of rental properties is limited.

Source: CoreLogic

With vacancy rates, according to SQM research, holding firm from May to June at 1 per cent, there is little hope that the rental squeeze will ease any time in the immediate future.

Summary

The Brisbane real estate market is incredibly resilient. If you are in the market to buy right now, you will have to be prepared to compete. There have been more buyers than sellers for several months, and this is putting pressure on prices, especially for quality properties in inner and middle ring locations.

Despite the national headlines for the broader Australian property market indicating that growth is easing in most regions, with new listings rising, this is certainly not the case in Brisbane.

Every month, there is the risk of interest rates rising, but it seems buyers are now pricing this in with a level of confidence that the top of the tightening cycle is approaching. We are still not seeing evidence of forced selling. If property owners are unable to repay their mortgage due to higher rates or the widely discussed mortgage cliff, then there should be enough buyers to compete for their property. This is more evident in some locations throughout Brisbane than others, and is something to watch out for in the coming months.

Based on the fundamentals, we do not see prices sliding backwards any time soon in Brisbane.