Rate increases: ‘Stop putting Aussies through brain damage’, says Mark Bouris

Mark Bouris lays out the argument on why rapid rate increases — which has been the Reserve Bank’s traditional weapon of choice against inflation — won’t just cut it anymore.

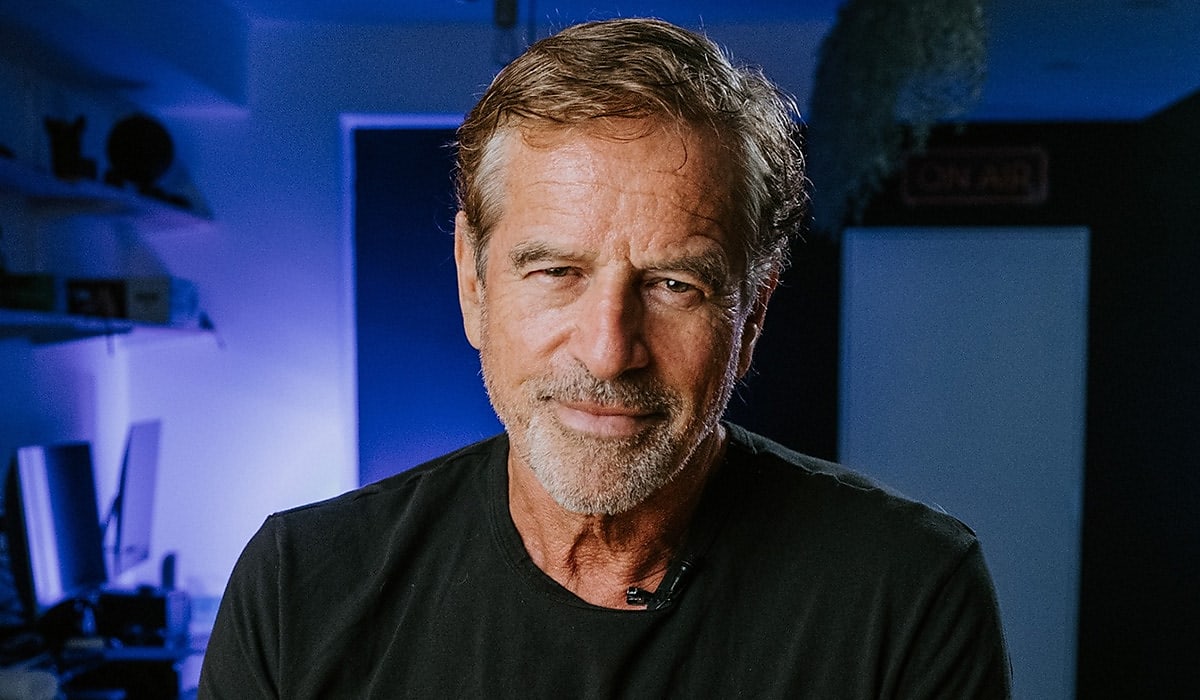

In this special episode, host Phil Tarrant sits down with Mark Bouris, the founder of Wizard Home Loans and Yellow Brick Road, to talk about why the central bank’s current approach to tackling the high inflationary levels is short-sighted, as it fails to consider current economic trends.

With this, the industry commentator called for the government, along with the RBA, to tweak its monetary and fiscal policies and explained why its inflation target band should be a medium-term goal rather than a short-term one based on the chain of events that unfolded during the country’s 1990s recession.

The pair also delves into how mortgage holders are specifically being “punished” by the rate hikes, the current state of play in the world of brokers and lenders, and unpacks what options are available to borrowers in today’s high-interest rate environment.

If you like this episode, show your support by rating us or leaving a review on Apple Podcasts and by following Smart Property Investment on social media: Facebook, Twitter and LinkedIn.

If you would like to get in touch with our team, email [email protected] for more insights, or hear your voice on the show by recording a question below.